How Often Does Credit Karma Update Credit Card Balances

Founded in 2007, Credit Karma is a San Francisco-based financial services company that offers costless credit scores to the masses. Credit Karma touts that it volition always be free to the consumers who use its website or mobile app.

Just how accurate is Credit Karma? In some cases, equally seen in an example below, Credit Karma may be off by 20 to 25 points.

On this folio:

- Comparison Nate'south Credit Scores on Credit Karma vs. Wells Fargo

- Types of Credit Scores Available

- Breaking Down FICO and VantageScore

- Other Differences to Recognize

Comparing Nate's Credit Scores on Credit Karma vs. Wells Fargo

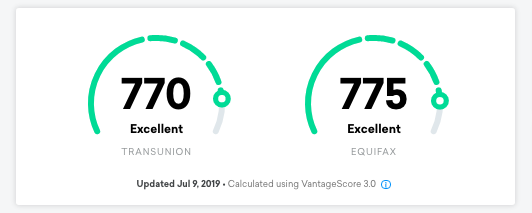

As an example, we experimented to run across how accurate Credit Karma'southward scores were for our Co-founder, Nate Matherson. Here is a screenshot from Nate'south Credit Karma business relationship:

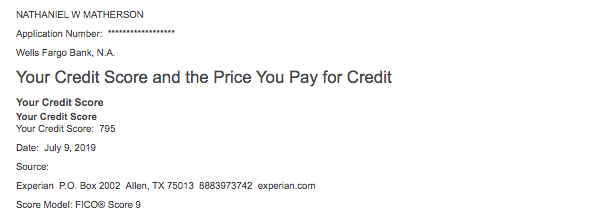

Too on July 9th, 2019, Nate applied for a personal line of credit from Wells Fargo. Hither is a screenshot from Nate's Wells Fargo loan application:

As yous can see in the examples to a higher place, Nate'due south Experian FICO Score nine was 25 points higher than his VantageScore from Transunion and xx points college than his VantageScore from Equifax.

In Nate's case, Credit Karma was authentic plenty to say that he had an excellent credit score, merely wasn't perfect.

Interested in viewing your costless credit score with Credit Karma?

- Receive alerts when changes to your reports occur

- View a breakdown of factors that are currently affecting your score

- Brand better decisions with personalized recommendations

Types of Credit Scores Bachelor

In the earth of consumer credit, there are several different credit scores that may be used by creditors to evaluate the risk of a new borrower.

Regardless of the type used, information like an individual'southward account payment history, number of accounts open and used, credit utilization percentage, and any negative credit issues are all included in the calculation of one's credit score.

An in-depth algorithm is applied to these details to derive a three-digit number ranging from 300 to 850, in nigh cases. The college the credit score, the more sound a borrower the private is perceived to be when a new awarding for credit is submitted.

While Credit Karma boasts its free credit score to anyone who wants it, the company provides access to an individual's VantageScore three.0, non the FICO Score that the majority of lenders use to evaluate an individual. The VantageScore 3.0 has the same credit score range as FICO and uses some of the same information a FICO Score does, but the manner in which the information is used to determine one's credit score is different.

When Credit Karma users see their credit score details on the site or the mobile app, they are viewing their VantageScore 3.0.

In addition to using a dissimilar type of credit score than almost lenders and financial institutions, Credit Karma also offers access to simply 2 credit scores from two of the credit reporting agencies.

Currently, Credit Karma allows users to see their Equifax VantageScore iii.0 and their TransUnion VantageScore iii.0 – not a credit score of any kind from Experian. Given that the iii credit reporting agencies all offer credit scores to individual consumers, missing the third may mean Credit Karma users are getting a slightly inaccurate picture of their credit contour.

Breaking Down FICO and VantageScore

When well-nigh people think about their credit score, whether they know it or not, they are thinking about FICO. The Fair Isaac Corporation introduced FICO credit scores for consumers back in 1989, and since and then the company has worked diligently to keep upwardly with consumer behaviors and how those bear on the FICO scoring calculations. Up until a decade agone, FICO was the just consumer credit score used by the three major credit reporting agencies, also as the simply score used by lenders and fiscal institutions.

In recent years, VantageScore has taken on the challenge of competing with FICO for its place at the top of the consumer credit scoring chain. By partnering with the three credit bureaus, VantageScore is able to apply similar information and scoring models as FICO to generate individual credit scores. Nonetheless, there are differences between FICO and VantageScore that consumers should be enlightened of.

First, information technology is important to understand that both the FICO and VantageScore methods draw from the same consumer data: payment history, credit usage, contempo inquiries, length of credit, and type of credit. Withal, these details are gathered in different ways.

FICO bases its scoring on the credit reports of millions of consumers at a time, received direct from the three credit bureaus to create the almost accurate scoring. VantageScore, on the other hand, uses consumer credit files in smaller sets to create its formula for scoring. Both end up with a score range of 300 to 850, merely that's where about of the similarities end.

VantageScore is more beneficial to consumers with a short credit history, as its scoring model only requires one month of activity and one business relationship reported to the credit bureaus to create a score. FICO, conversely, requires at to the lowest degree 6 months of credit history and one business relationship reported. This means, at least initially, a VantageScore may be far college than a FICO score for the same private.

Similarly, VantageScore and FICO have a departure of stance when it comes to tardily payments. For FICO score calculations, payment history makes up 35 percent, although all belatedly payments are viewed in the same way. VantageScore calculations penalize late mortgage payments more than harshly than other credit accounts, dropping an individual's VantageScore down more than then than their FICO score.

Overall, viewing ane'due south credit score on Credit Karma may produce a different consequence than viewing information technology through ane or more of the credit bureaus straight. The slight differences in calculations between VantageScore and FICO credit scores can lead to pregnant variations in scores, making Credit Karma less accurate than virtually may appreciate.

Other Differences to Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring marketplace has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score – one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, automobile loan lenders take an Auto Score available from FICO that uses the same credit information to make up one's mind specific risk factors a borrower may show as information technology relates to defaulting on a new car loan. The aforementioned is true for credit carte issuers (FICO Bankcard Score), mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, at that place are at least two versions yet in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to summate an individual's credit score are varied enough to create multiple scores for a unmarried person at any given fourth dimension.

The idea of having several dissimilar credit scores out there in the world can be a bit overwhelming. Fortunately, a tool like Credit Karma keeps the process of monitoring VantageScore credit scores from Equifax and TransUnion fairly straightforward. It is, however, important for consumers to take the time (and nominal toll) to also review their FICO credit scores from each of the three major credit bureaus every now and again. This ensures at that place are no major discrepancies, and that scores are in the healthiest possible range.

Source: https://lendedu.com/blog/accurate-credit-karma/

Posted by: bryanontepairt.blogspot.com

0 Response to "How Often Does Credit Karma Update Credit Card Balances"

Post a Comment